.................NATURAL GAS>>>>>>>

.................NATURAL GAS>>>>>>> WE ARE THE WEALTH MAKER ,WE HAVE EXPERIENCED TECHNICAL & FUNDAMENTAL RESEARCH TEAM SHARING VIEW ON MARKET FOR EDUCATIONAL PURPOSE

WELCOME

Monday, 8 July 2013

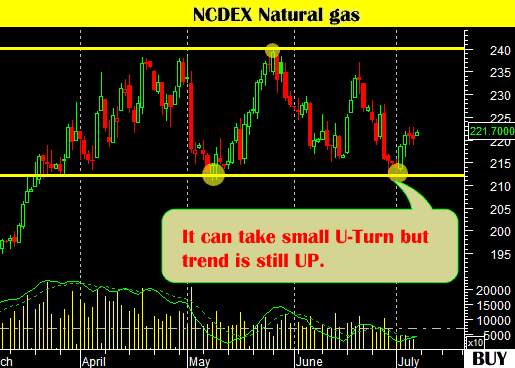

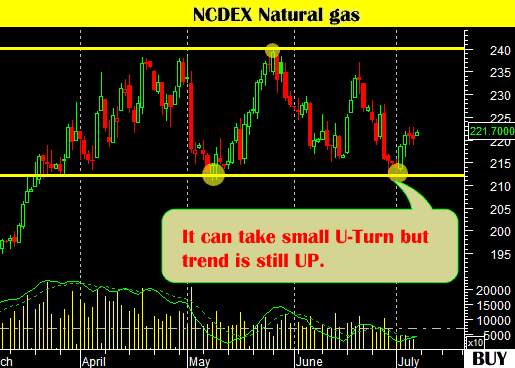

NATURAL GAS ON CHART

.................NATURAL GAS>>>>>>>

.................NATURAL GAS>>>>>>> CURRENCY & COMMODITIES VIEW

Major Forex News

Yen Dollar Index Reaches Three-Year High as Jobs Gain Beats Forecast

The Dollar Index climbed to the highest level since 2010 after U.S. employers added more jobs than

forecast in June, fueling bets the Federal Reserve will begin slowing unprecedented monetary stimulus.

The U.S. currency rose versus most major peers. The dollar gauge, which Intercontinental Exchange Inc.

uses to track the greenback versus currencies of six major U.S. trade partners, has gained 4.7 percent

since June 18, the day before Fed Chairman Ben S. Bernanke said the central bank may begin cutting bond

buying this year if growth meets officials’ forecasts.

U.S. payrolls rose in June by 195,000 workers, more than forecast, for a second straight month, the Labor

Department reported today in Washington. The jobless rate stayed at 7.6 percent, while hourly earnings

in the year ended in June advanced by the most since July 2011. “These are really strong numbers, and

there was an expected strong dollar response across the board.The Dollar Index advanced 1.4 percent to

84.406 at 9:23 a.m. in New York. It jumped as much as 1.6 percent, the biggest intraday gain since

November 2011, to 84.530, the highest level since July 13, 2010. The gauge was poised for its third weekly

gain, the longest winning stretch since March.

The dollar appreciated 0.7 percent to $1.2831 per euro and touched $1.2806, its strongest level since May

17. The greenback rose 0.8 percent to 100.88 yen after reaching 101.14, the highest since May 31. The

Japanese currency declined 0.2 percent to 129.45 per euro.

The 17-nation currency fell yesterday against the greenback as European Central Bank President Mario

Draghi pledged to keep rates at a record low for an extended period.

U.S. payrolls rose by 195,000 workers for a second straight month, the Labor Department reported today

in Washington. The median forecast in a Bloomberg survey projected a 165,000 gain after a previously

reported 175,000 increase in May. The jobless rate stayed at 7.6 percent, while hourly earnings in the

year ended in June advanced by the most since July 2011.

Payrolls have increased by an average of 189,000 jobs each month this year through May, Labor

Department data show. They grew in 2011 and 2012 by an average of 179,000 a month.

The Dollar Index fell 0.2 percent on April 5 when the Labor Department said employers added 88,000

workers the previous month, less than half a Bloomberg survey projection for an increase of 190,000

positions, fueling speculation U.S. growth was slowing.

The Fed is buying $85 billion of Treasuries and mortgage bonds every month to put downward pressure

on borrowing costs during the third round of its quantitative-easing stimulus program. It purchased $2.3

trillion of assets from 2008 to 2011 in the first two rounds.

Bernanke said last month after a two-day Federal Open Market Committee meeting the central bank may

reduce the purchases this year and end them in mid-2014 if economic growth meets policy makers’

projections. Fed officials forecast expansion of as much as 2.6 percent this year and 3.5 percent in 2014.

The Commerce Department reported June 26 U.S. gross domestic product expanded at a revised 1.8

percent annualized rate from January through March, down from a prior estimate of 2.4 percent.

Policy makers have also kept the key interest-rate target at zero to 0.25 percent since 2008 to support the

economy. A rate increase is far in the future.

The Fed has said it will keep the rate at almost zero as long as unemployment remains above 6.5 percent

and the outlook for inflation doesn’t exceed 2.5 percent. Asset purchases may continue in 2014 until

unemployment declines to about 7 percent, Bernanke said last month.

COMMODITIES...>>>>>

Subscribe to:

Comments (Atom)